Transaction Types can play an important role in tracking transactions as they can indicate what type of transaction occurred. There is a large variety of default transaction types available for use in general transactions and investment transactions. You can also setup custom transaction types if desired. Assign colors to transaction types to make them more easily identifiable in transactions and reports when using the options in the Colors preferences. With the exception of investment transactions, the use of transaction types in transactions is optional. The list of transaction types can be found in the Lists - Transaction Types section. Learn more about the details transaction types can have as well as how to create, edit, and delete your own custom transaction types below.

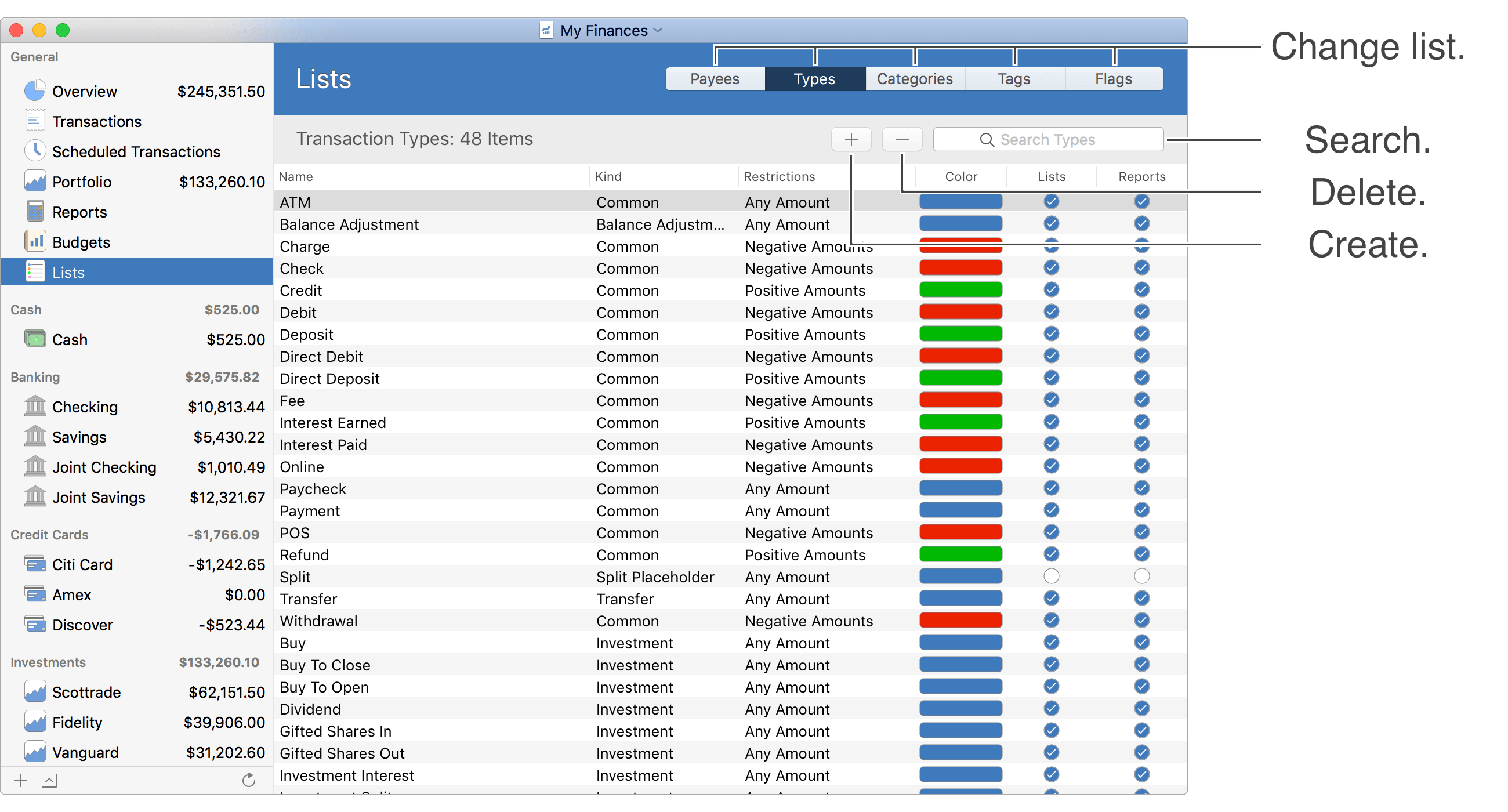

Transaction Types list

General layout info:

![]() Tip:

When viewing items in tables, you can control the fields shown by adjusting the optional columns.

Adjust the optional columns for a table by using the program's View → Columns menu or by Control-clicking on an uneditable area of the table.

Tip:

When viewing items in tables, you can control the fields shown by adjusting the optional columns.

Adjust the optional columns for a table by using the program's View → Columns menu or by Control-clicking on an uneditable area of the table.

Default transaction types:

Every file gets setup with a large set of common transaction types. There are also some special transaction types that are used in certain situations such as for balance adjustments and investment specific transaction types for use when recording investment transactions. Learn more about the default transaction types below.

![]()

![]() ATM: Intended for use in ATM deposit and withdrawal transactions.

Allows for positive or negative transaction amounts.

ATM: Intended for use in ATM deposit and withdrawal transactions.

Allows for positive or negative transaction amounts.

![]()

![]() Balance Adjustment: For use when recording balance adjustment transactions.

Allows for positive or negative transaction amounts.

Balance Adjustment: For use when recording balance adjustment transactions.

Allows for positive or negative transaction amounts.

![]() Charge: Intended for use when recording credit card expense transactions.

Restricted to negative transaction amounts.

Charge: Intended for use when recording credit card expense transactions.

Restricted to negative transaction amounts.

![]() Check: Intended to record transactions paid by check.

Restricted to negative transaction amounts.

Check: Intended to record transactions paid by check.

Restricted to negative transaction amounts.

![]() Credit: Intended to be used for recording any type of credit/increase to an account.

Restricted to positive transaction amounts.

Credit: Intended to be used for recording any type of credit/increase to an account.

Restricted to positive transaction amounts.

![]() Debit: Intended to be used to record any type of debit/decrease from an account.

Restricted to negative transaction amounts.

Debit: Intended to be used to record any type of debit/decrease from an account.

Restricted to negative transaction amounts.

![]() Deposit: Intended for use to record deposits in accounts.

Restricted to positive transaction amounts.

Deposit: Intended for use to record deposits in accounts.

Restricted to positive transaction amounts.

![]() Direct Debit: Intended for use to record expenses made directly into accounts via electronic means.

Restricted to negative transaction amounts.

Direct Debit: Intended for use to record expenses made directly into accounts via electronic means.

Restricted to negative transaction amounts.

![]() Direct Deposit: Intended for use to record deposits made directly from accounts via electronic means.

Restricted to positive transaction amounts.

Direct Deposit: Intended for use to record deposits made directly from accounts via electronic means.

Restricted to positive transaction amounts.

![]() Fee: Intended to record various fee transactions.

Restricted to negative transaction amounts.

Fee: Intended to record various fee transactions.

Restricted to negative transaction amounts.

![]() Interest Earned: Intended to record interest income.

Restricted to positive transaction amounts.

Interest Earned: Intended to record interest income.

Restricted to positive transaction amounts.

![]() Interest Paid: Intended to record interest payments.

Restricted to negative transaction amounts.

Interest Paid: Intended to record interest payments.

Restricted to negative transaction amounts.

![]() Online: Intended to record online/internet related purchases.

Restricted to negative transaction amounts.

Online: Intended to record online/internet related purchases.

Restricted to negative transaction amounts.

![]()

![]() Paycheck: Intended to record income paycheck transactions.

Allows for positive or negative transaction amounts.

Typically a positive amount for a deposited check.

Paycheck: Intended to record income paycheck transactions.

Allows for positive or negative transaction amounts.

Typically a positive amount for a deposited check.

![]()

![]() Payment: Intended to be used to record payment transactions.

Allows for positive or negative transaction amounts.

Payment: Intended to be used to record payment transactions.

Allows for positive or negative transaction amounts.

![]() POS: Intended to record point of sale (POS) transactions at brick and mortar businesses.

Restricted to negative transaction amounts.

POS: Intended to record point of sale (POS) transactions at brick and mortar businesses.

Restricted to negative transaction amounts.

![]() Refund: Intended to record refunds.

Restricted to positive transaction amounts.

Refund: Intended to record refunds.

Restricted to positive transaction amounts.

![]()

![]() Split: A placeholder for a transaction's transaction type for when it is split with varying transaction types.

Allows for positive or negative transaction amounts.

Split: A placeholder for a transaction's transaction type for when it is split with varying transaction types.

Allows for positive or negative transaction amounts.

![]()

![]() Transfer: Intended to be used to record transfer transactions between accounts.

Allows for positive or negative transaction amounts.

Transfer: Intended to be used to record transfer transactions between accounts.

Allows for positive or negative transaction amounts.

![]() Withdrawal: Intended to be used to record account withdrawals.

Restricted to negative transaction amounts.

Withdrawal: Intended to be used to record account withdrawals.

Restricted to negative transaction amounts.

![]()

![]() Buy: Used to record any purchase of a security.

Allows for positive or negative transaction amounts.

Typically a negative amount for the cash spent acquiring the shares.

Buy: Used to record any purchase of a security.

Allows for positive or negative transaction amounts.

Typically a negative amount for the cash spent acquiring the shares.

![]()

![]() Buy to Close: Used to record the purchase of a derivative which closes or decreases the short position on the derivative.

Allows for positive or negative transaction amounts.

Typically a negative amount for the cash spent acquiring the shares.

Buy to Close: Used to record the purchase of a derivative which closes or decreases the short position on the derivative.

Allows for positive or negative transaction amounts.

Typically a negative amount for the cash spent acquiring the shares.

*Does not currently behave any differently compared to the "Buy" transaction type.

![]()

![]() Buy to Open: Used to record the purchase of a derivative which opens or increases the long position on the derivative.

Allows for positive or negative transaction amounts.

Typically a negative amount for the cash spent acquiring the shares.

Buy to Open: Used to record the purchase of a derivative which opens or increases the long position on the derivative.

Allows for positive or negative transaction amounts.

Typically a negative amount for the cash spent acquiring the shares.

*Does not currently behave any differently compared to the "Buy" transaction type.

![]()

![]() Dividend: Used to record cash dividend income transactions.

Allows for positive or negative transaction amounts.

Typically a positive amount for the cash value of the dividend received.

Dividend: Used to record cash dividend income transactions.

Allows for positive or negative transaction amounts.

Typically a positive amount for the cash value of the dividend received.

![]()

![]() Gifted Shares In: Used to record the transfer of shares into an account due to being a gift.

Allows for positive or negative transaction amounts.

Typically a negative amount for the cost basis of the shares.

Gifted Shares In: Used to record the transfer of shares into an account due to being a gift.

Allows for positive or negative transaction amounts.

Typically a negative amount for the cost basis of the shares.

![]()

![]() Gifted Shares Out: Used to record the transfer of shares out of an account due to being a gift.

Allows for positive or negative transaction amounts.

Typically a positive amount for the cash value of the shares.

Gifted Shares Out: Used to record the transfer of shares out of an account due to being a gift.

Allows for positive or negative transaction amounts.

Typically a positive amount for the cash value of the shares.

![]()

![]() Investment Interest: Used to record investment interest income or interest paid.

Allows for positive or negative transaction amounts.

Typically a positive amount for investment interest earned.

Investment Interest: Used to record investment interest income or interest paid.

Allows for positive or negative transaction amounts.

Typically a positive amount for investment interest earned.

![]()

![]() Investment Split: Used to update an investment holding that had the number of shares "split" into either additional shares for every held share or a reduction in the number of shares for every held share.

Allows for positive or negative transaction amounts.

Usually a zero amount transaction.

Investment Split: Used to update an investment holding that had the number of shares "split" into either additional shares for every held share or a reduction in the number of shares for every held share.

Allows for positive or negative transaction amounts.

Usually a zero amount transaction.

![]() LT Cap. Gain: Used to record long term capital gain transactions.

Restricted to positive transaction amounts.

LT Cap. Gain: Used to record long term capital gain transactions.

Restricted to positive transaction amounts.

![]() LT Cap. Loss: Used to record long term capital loss transactions.

Restricted to negative transaction amounts.

LT Cap. Loss: Used to record long term capital loss transactions.

Restricted to negative transaction amounts.

![]()

![]() Margin Interest: Used to record margin interest transactions.

Allows for positive or negative transaction amounts.

Typically a negative amount.

Margin Interest: Used to record margin interest transactions.

Allows for positive or negative transaction amounts.

Typically a negative amount.

![]() Misc. Inv. Expense: Used to record miscellaneous investment expenses not appropriate for any another investment transaction type.

Restricted to negative transaction amounts.

Misc. Inv. Expense: Used to record miscellaneous investment expenses not appropriate for any another investment transaction type.

Restricted to negative transaction amounts.

![]() Misc. Inv. Income: Used to record miscellaneous investment income not appropriate for any another investment transaction type.

Restricted to positive transaction amounts.

Misc. Inv. Income: Used to record miscellaneous investment income not appropriate for any another investment transaction type.

Restricted to positive transaction amounts.

![]() MT Cap. Gain: Used to record medium term capital gain transactions.

Restricted to positive transaction amounts.

MT Cap. Gain: Used to record medium term capital gain transactions.

Restricted to positive transaction amounts.

![]() MT Cap. Loss: Used to record medium term capital loss transactions.

Restricted to negative transaction amounts.

MT Cap. Loss: Used to record medium term capital loss transactions.

Restricted to negative transaction amounts.

![]()

![]() Reinvest Dividend: Used to record a dividend from an investment that was reinvested to acquire additional shares of the investment.

Allows for positive or negative transaction amounts.

Typically a positive amount for the cash value of the dividend received.

Reinvest Dividend: Used to record a dividend from an investment that was reinvested to acquire additional shares of the investment.

Allows for positive or negative transaction amounts.

Typically a positive amount for the cash value of the dividend received.

![]()

![]() Reinvest Income: Used to record income received from an investment that was reinvested to acquire additional shares of the investment.

Allows for positive or negative transaction amounts.

Typically a positive amount for the cash value of the dividend received.

Reinvest Income: Used to record income received from an investment that was reinvested to acquire additional shares of the investment.

Allows for positive or negative transaction amounts.

Typically a positive amount for the cash value of the dividend received.

![]()

![]() Reinvest LT Cap. Gain: Used to record income received from an investment long term capital gain which was reinvested to acquire additional shares of the investment.

Allows for positive or negative transaction amounts.

Typically a positive amount for the cash value of the dividend received.

Reinvest LT Cap. Gain: Used to record income received from an investment long term capital gain which was reinvested to acquire additional shares of the investment.

Allows for positive or negative transaction amounts.

Typically a positive amount for the cash value of the dividend received.

![]()

![]() Reinvest MT Cap. Gain: Used to record income received from an investment medium term capital gain which was reinvested to acquire additional shares of the investment.

Allows for positive or negative transaction amounts.

Typically a positive amount for the cash value of the dividend received.

Reinvest MT Cap. Gain: Used to record income received from an investment medium term capital gain which was reinvested to acquire additional shares of the investment.

Allows for positive or negative transaction amounts.

Typically a positive amount for the cash value of the dividend received.

![]()

![]() Reinvest ST Cap. Gain: Used to record income received from an investment short term capital gain which was reinvested to acquire additional shares of the investment.

Allows for positive or negative transaction amounts.

Typically a positive amount for the cash value of the dividend received.

Reinvest ST Cap. Gain: Used to record income received from an investment short term capital gain which was reinvested to acquire additional shares of the investment.

Allows for positive or negative transaction amounts.

Typically a positive amount for the cash value of the dividend received.

![]()

![]() Return of Capital: Used to record the return of capital from a held investment.

Allows for positive or negative transaction amounts.

Typically a positive amount for the cash received.

Return of Capital: Used to record the return of capital from a held investment.

Allows for positive or negative transaction amounts.

Typically a positive amount for the cash received.

![]()

![]() Sell: Used to record any sale of a security.

Allows for positive or negative transaction amounts.

Typically a positive amount for the cash received for the shares.

Sell: Used to record any sale of a security.

Allows for positive or negative transaction amounts.

Typically a positive amount for the cash received for the shares.

![]()

![]() Sell to Close: Used to record the sale of a derivative which closes or decreases the long position on the derivative.

Allows for positive or negative transaction amounts.

Typically a positive amount for the cash received for the shares.

Sell to Close: Used to record the sale of a derivative which closes or decreases the long position on the derivative.

Allows for positive or negative transaction amounts.

Typically a positive amount for the cash received for the shares.

*Does not currently behave any differently compared to the "Sell" transaction type.

![]()

![]() Sell to Open: Used to record the sale of a derivative which opens or increases the short position on the derivative.

Allows for positive or negative transaction amounts.

Typically a positive amount for the cash received for the shares.

Sell to Open: Used to record the sale of a derivative which opens or increases the short position on the derivative.

Allows for positive or negative transaction amounts.

Typically a positive amount for the cash received for the shares.

*Does not currently behave any differently compared to the "Sell" transaction type.

![]()

![]() Shares In: Used to record the transfer of shares into an account or can be used to record a position adjustment for an investment holding.

Allows for positive or negative transaction amounts.

Typically a negative amount for the cost basis of the shares.

Shares In: Used to record the transfer of shares into an account or can be used to record a position adjustment for an investment holding.

Allows for positive or negative transaction amounts.

Typically a negative amount for the cost basis of the shares.

![]()

![]() Shares Out: Used to record the transfer of shares out of an account or can be used to record a position adjustment for an investment holding.

Allows for positive or negative transaction amounts.

Typically a positive amount for the cash value of the shares.

Shares Out: Used to record the transfer of shares out of an account or can be used to record a position adjustment for an investment holding.

Allows for positive or negative transaction amounts.

Typically a positive amount for the cash value of the shares.

![]() ST Cap. Gain: Used to record short term capital gain transactions.

Restricted to positive transaction amounts.

ST Cap. Gain: Used to record short term capital gain transactions.

Restricted to positive transaction amounts.

![]() ST Cap. Loss: Used to record short term capital loss transactions.

Restricted to negative transaction amounts.

ST Cap. Loss: Used to record short term capital loss transactions.

Restricted to negative transaction amounts.

![]() Note:

The default transaction types cannot be renamed or deleted.

Note:

The default transaction types cannot be renamed or deleted.

![]() Note:

When entering transactions in asset, income, banking, loan (lending) and investment accounts, positive transaction values increase the account's balance (and increases your net worth) and negative transaction values decrease the account's balance (and decreases your net worth).

When entering transactions in liability, credit card, and loan (borrowing) accounts, positive transaction values decrease the account's balance (and increases your net worth) and negative transaction values increase the account's balance (and decreases your net worth).

Note:

When entering transactions in asset, income, banking, loan (lending) and investment accounts, positive transaction values increase the account's balance (and increases your net worth) and negative transaction values decrease the account's balance (and decreases your net worth).

When entering transactions in liability, credit card, and loan (borrowing) accounts, positive transaction values decrease the account's balance (and increases your net worth) and negative transaction values increase the account's balance (and decreases your net worth).

Transaction Type details:

Transaction Types have variety of details in addition to the basic details of name and color. Learn more about the different details for transaction types below.

- Name: The name for the transaction type.

- Description: A brief description for the transaction type.

- Kind: The type of transaction type: "Custom", "Common", "Balance Adjustment", "Split Placeholder", "Transfer", or "Investment". The "Common", "Balance Adjustment", "Split Placeholder", "Transfer", and "Investment" kinds of transaction types are default transaction types.

- Restrictions: The restrictions on the amount for a transaction when the transaction type is used: "Any Amount", "Positive Amounts" or "Negative Amounts". For transaction types using the "Positive Amounts" option you will not be allowed to enter a negative amount. For transaction types using the "Negative Amounts" option you will not be allowed to enter a positive amount and therefore won't need to enter the minus sign when entering amounts for transactions using that transaction type.

- Color: The color for the transaction type. If a color is not set for transaction type then the default color will be used based on the "Restrictions" for transaction type: "Any Amount" defaults to blue, "Positive Amounts" defaults to green, and "Negative Amounts" defaults.

- Include in Lists: Controls whether or not the transaction type is a selectable option when selecting transaction types in various lists throughout the program.

- Include in Reports: Controls whether or not the transaction type is included in reports when using the default transaction type options such as "All Transaction Types". Transaction types that have this option off can be added to reports by choosing the "Specific Transaction Types" option for the report then using the "Show Hidden" option to access the transaction type.