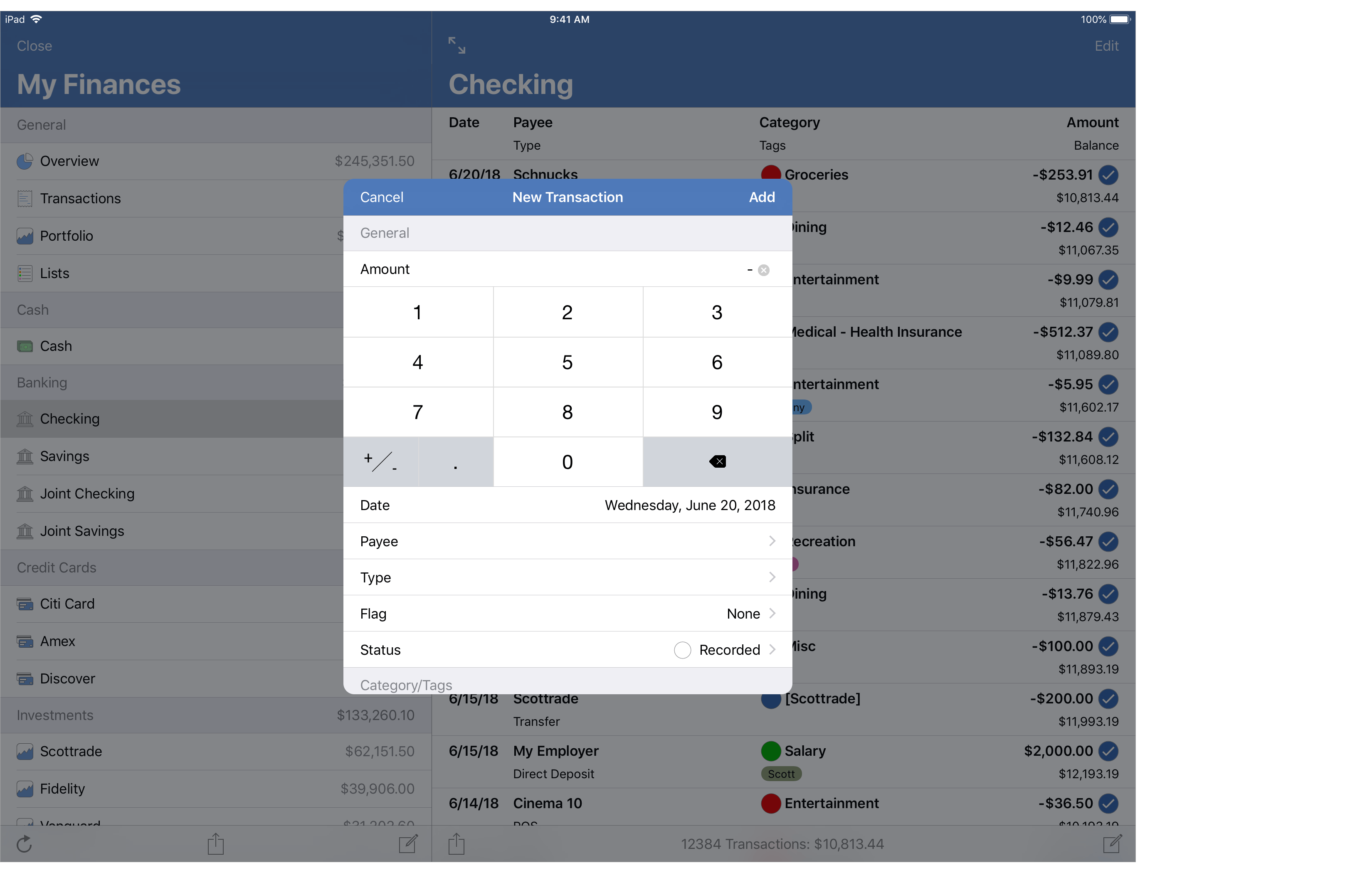

![]() Transactions are the fundamental pieces for recording your finances in SEE Finance.

Recording transactions in detail will make tracking your income and expenses more productive through the use of payees, transaction types, categories, tags plus some other transactions settings.

Track the status of transactions from "Pending" to "Reconciled" as desired.

Split transactions when needed to keep a detailed breakdown of the different items the transactions covered.

Transactions are the fundamental pieces for recording your finances in SEE Finance.

Recording transactions in detail will make tracking your income and expenses more productive through the use of payees, transaction types, categories, tags plus some other transactions settings.

Track the status of transactions from "Pending" to "Reconciled" as desired.

Split transactions when needed to keep a detailed breakdown of the different items the transactions covered.

Transaction details:

Transactions can have a wide variety of details in addition to the basic details of date, payee and amount. Learn more about the many possible details a transaction can have below.

General transaction details:

- Flag: A marker used to easily identify transactions that are "Unreviewed"

, "Needs further review"

, "Needs further review"  or with your own custom flag.

Imported transactions are flagged as "Unreviewed"

or with your own custom flag.

Imported transactions are flagged as "Unreviewed"  by default.

by default. - Origin: How the transaction was originally created such as by manual entry

or by import

or by import  .

. - Date: The date the transaction occurred.

- Account: The account the transaction occurred in.

- Payee: The payee (or payor) name for the transaction.

- Transaction Type: The type of transaction such as Deposit or Debit. The transaction type can restrict whether or not a transaction can only have a positive or negative amount.

- Category: The category for the transaction. Categorizing transactions help to track income and expenses in reports and for keeping a budget. You will also use categories to indicate account transfers.

- Tags: The tags for the transaction. Tagging transactions can add another dimension to your transaction tracking beyond what you can accomplish with categories. Common uses for tags include tagging business and personal expenses separately and/or having tags for each member of a family.

- Memo: A short note or description for the transaction.

- Number: The transaction number such as an invoice number. Separate from a transaction's check number.

- Check Number: The check number for the transaction.

- Decrease: A negative amount for the transaction. Reduces an account's balance. Listed as "Charge" for credit card accounts. Decreases an account's outstanding balance for cash, banking, investment, asset and other accounts that generally have positive outstanding balances. Increases an account's outstanding balance for credit card, liability and other accounts that can have negative outstanding balances. Can be disabled for when a transaction type is set with a positive amount only amount restriction.

- Increase: A positive amount for the transaction. Listed as "Payment" for credit card accounts. Increases an account's outstanding balance for cash, banking, investment, asset and other accounts that generally have positive outstanding balances. Decreases an account's outstanding balance for credit card, liability and other accounts that can have negative outstanding balances. Can be disabled for when a transaction type is set with a negative amount only amount restriction.

- Amount: The amount for the transaction. Can be a positive or negative amount depending on the transaction type's amount restriction.

- Balance: The account's running cash balance as of the transaction. For Single Mutual Fund investment accounts, the running share balance as of the transaction.

- Reconciled: The account's running reconciled cash balance as of the transaction. For Single Mutual Fund investment accounts, the running reconciled share balance as of the transaction.

- Attachments: Attached images or other files for the transaction. Add attachments for transactions for an extra level of detail. Add receipt images or other files such as warranty info or a manual for an item purchased.

- Status: The current status of the transaction.

Mark transactions as

"Pending"

,

"Recorded"

,

"Recorded"  ,

"Cleared"

,

"Cleared"  ,

"Reconciled"

,

"Reconciled"  , or

"Voided"

, or

"Voided"  .

.

Investment transaction details:

- Security: The security for an investment transaction.

- Units: The number of units for an investment transaction.

- Price: The price per unit for an investment transaction.

- Commission: The commission paid for an investment transaction.

Imported transaction details:

Transactions imported from a Financial Institution can have the following FI values you can use for referencing the original information listed by the institution.

- FI Date: The date for the transaction when cleared by institution.

- FI ID: The unique ID for the transaction as listed by the institution.

*Specific to transactions originating from Direct Connect downloads, QFX and OFX file imports. - FI Payee: The payee, payor or description of the transaction as listed by the institution.

- FI Transaction Type: The transaction type as indicated by the institution.

- FI Category: The category as set by the institution.

*Only possibly set for transactions originating from QIF and CSV file imports. - FI Memo: The note or description for the transaction as listed by the institution.

- FI Number: The transaction number as listed by the institution.

- FI Check Number: The check number as as listed by the institution.