Reconciling your accounts is an important part of tracking your finances as it performs two important functions: making sure your accounts are balanced by comparing your records against the institution's records and for verifying the transactions are legitimate. Through the use of the different transaction status options, every transaction can evolve from "Pending" to "Recorded" to "Cleared" to "Reconciled" or through any combination of those. Periodically reconcile your accounts to verify your transaction records against the institution's and then mark the matching transactions as "Reconciled". You can reconcile accounts against official statements or simply against the transaction records available on the institution's website or app. Learn more about where to find an account's reconciled balance, how to mark transactions as reconciled either individually or in bulk, and how to reconcile an account below.

Reconciled balance

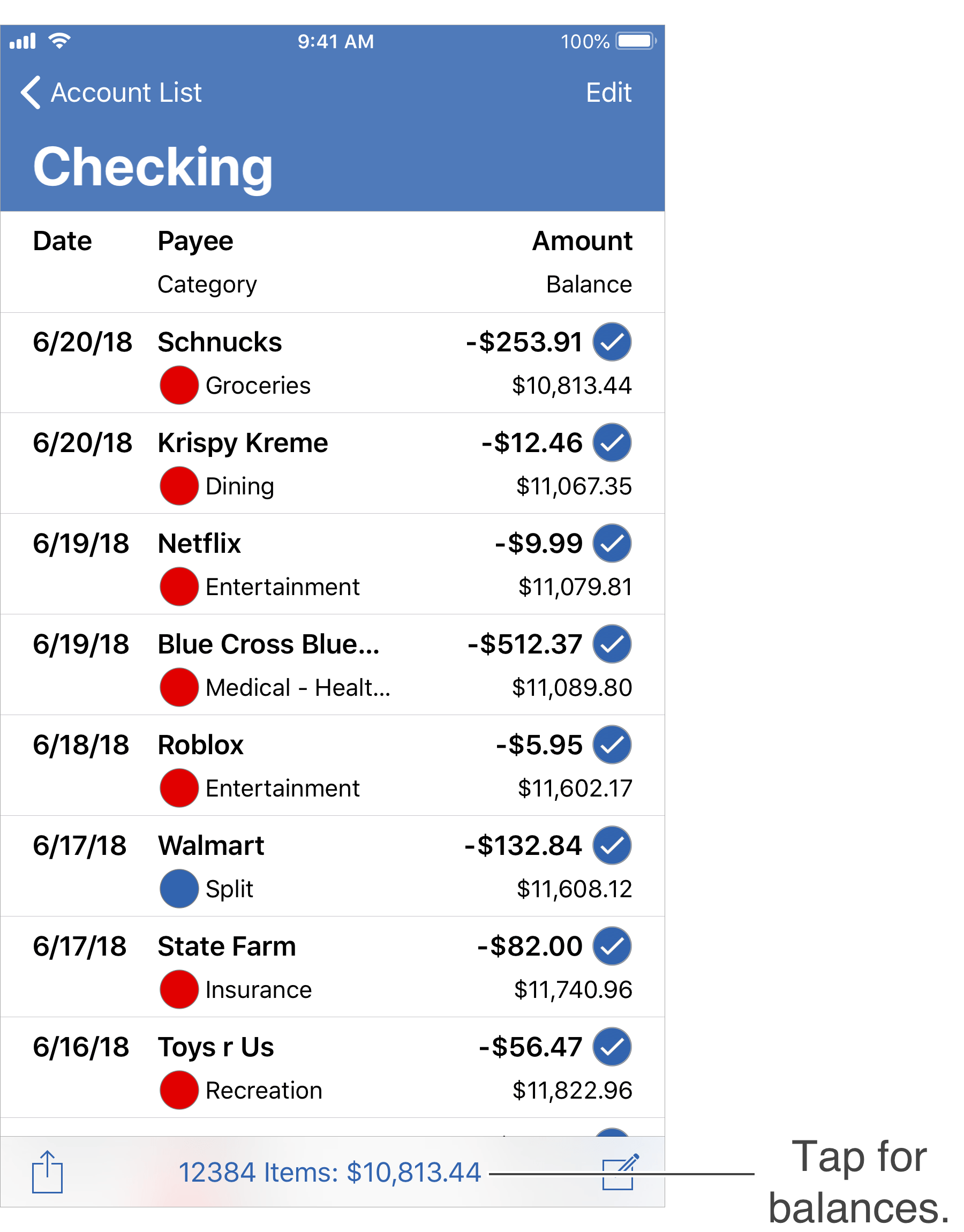

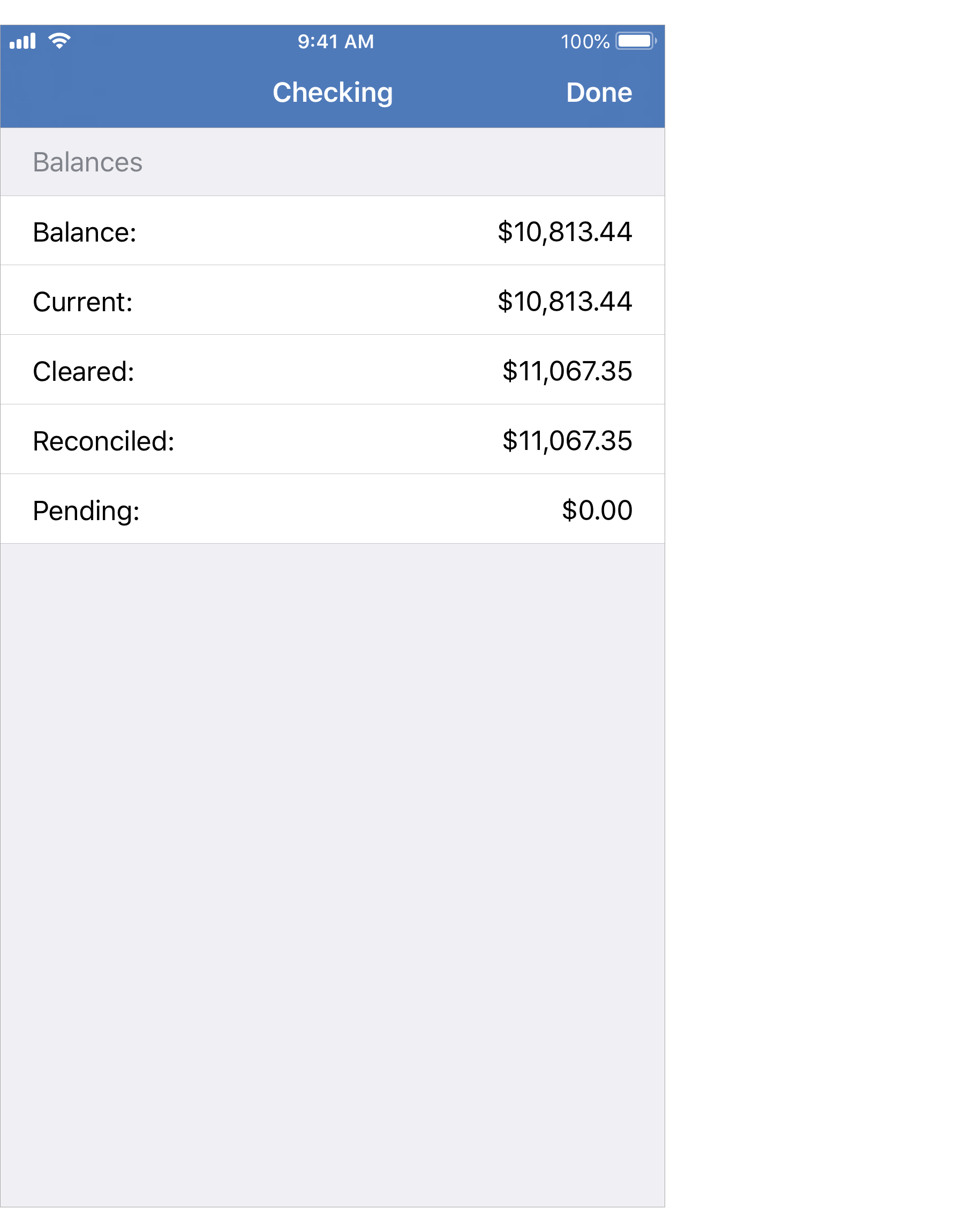

View an account's "Reconciled" balance, and other additional account balance information, by tapping on the number of transactions and balance info at the bottom of the account.

Or tap ![]() on the lower left of the account's view and then choose the "Show Balance Info" option.

on the lower left of the account's view and then choose the "Show Balance Info" option.

Additional balances:

Mark a transaction as reconciled:

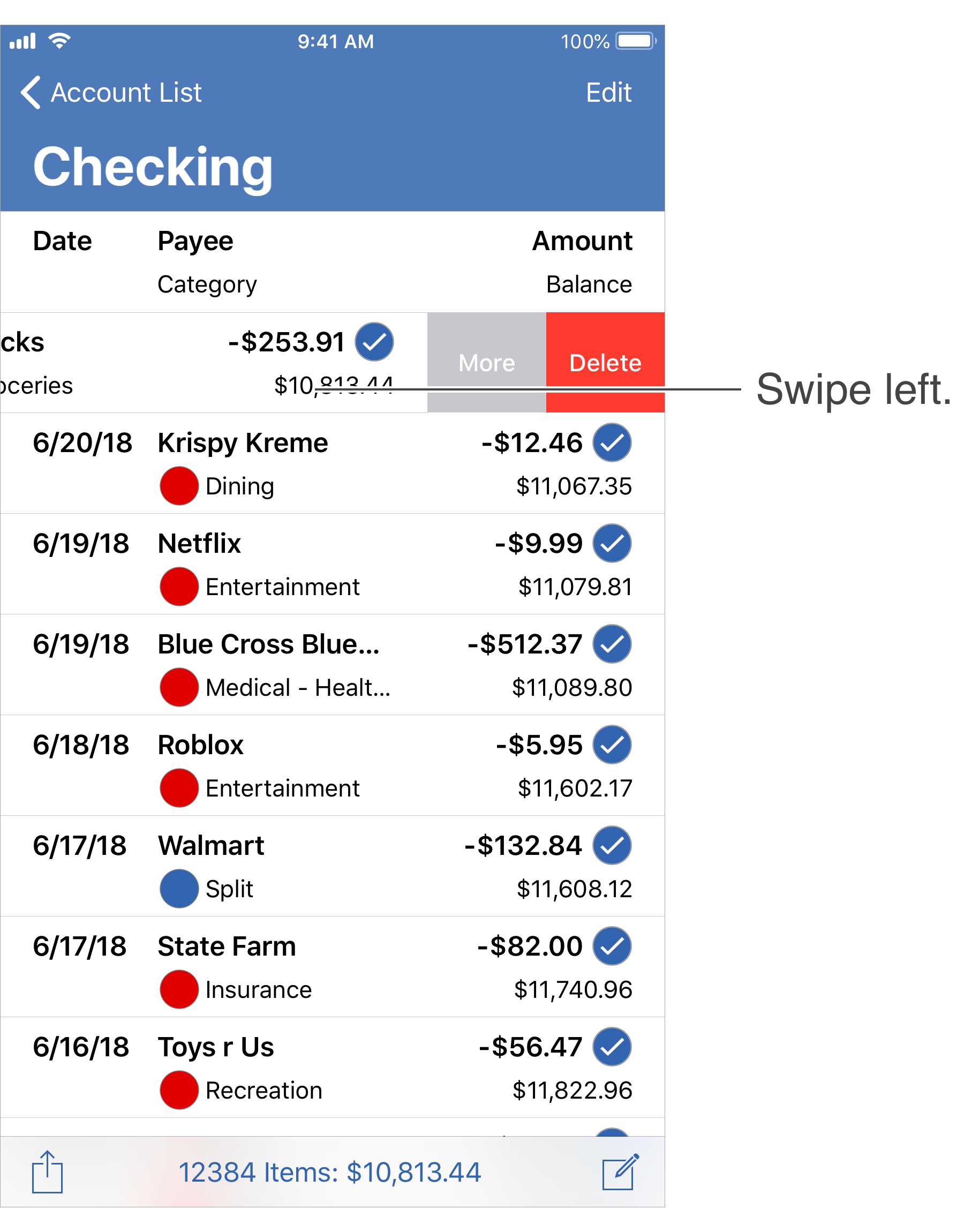

- Swipe left on the transaction you want to mark as reconciled and then tap "More".

- Tap the "Mark as Reconciled" option.

![]() Tip:

You can also mark a transaction as reconcile when editing transactions.

Tip:

You can also mark a transaction as reconcile when editing transactions.

Mark multiple transactions as reconciled:

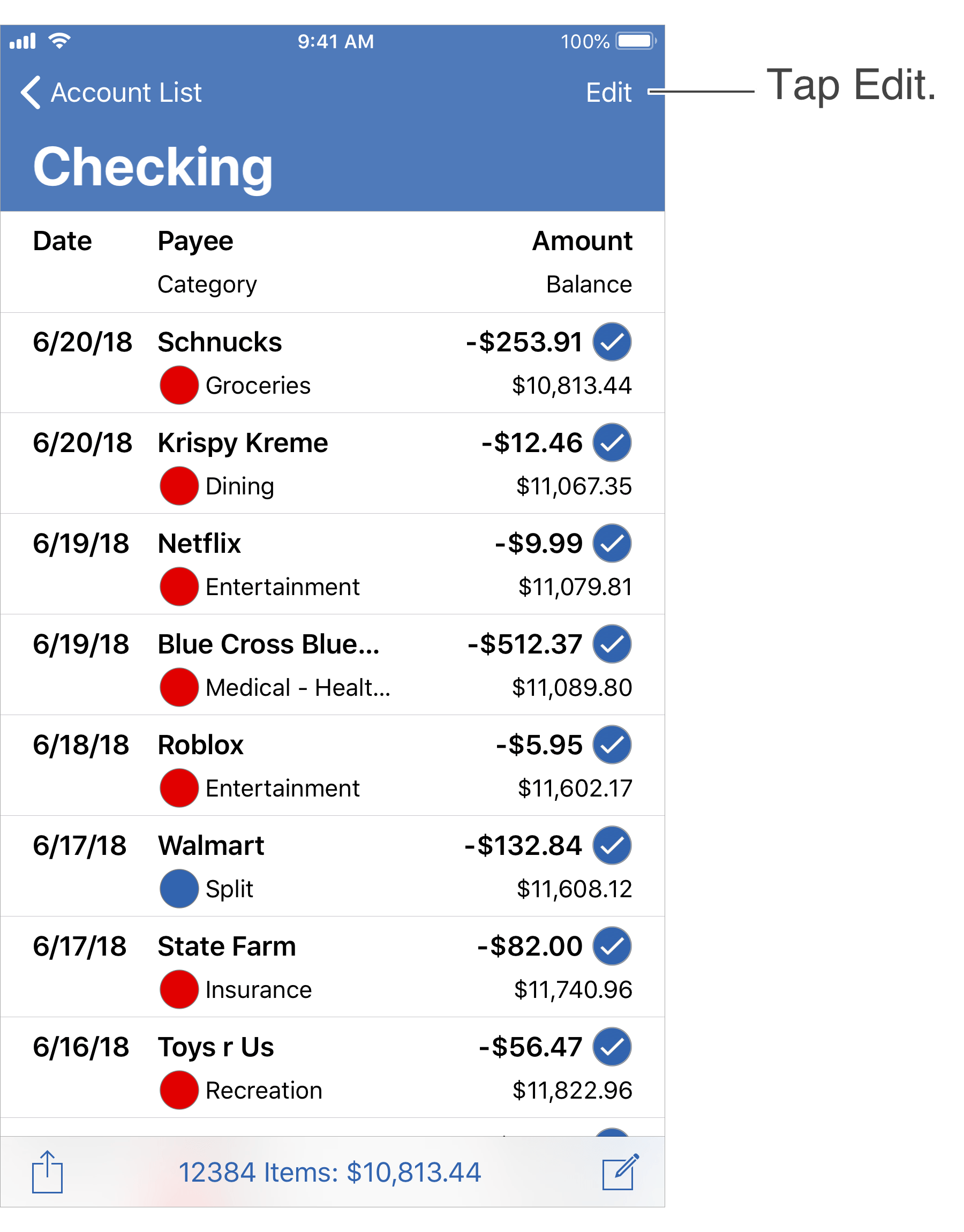

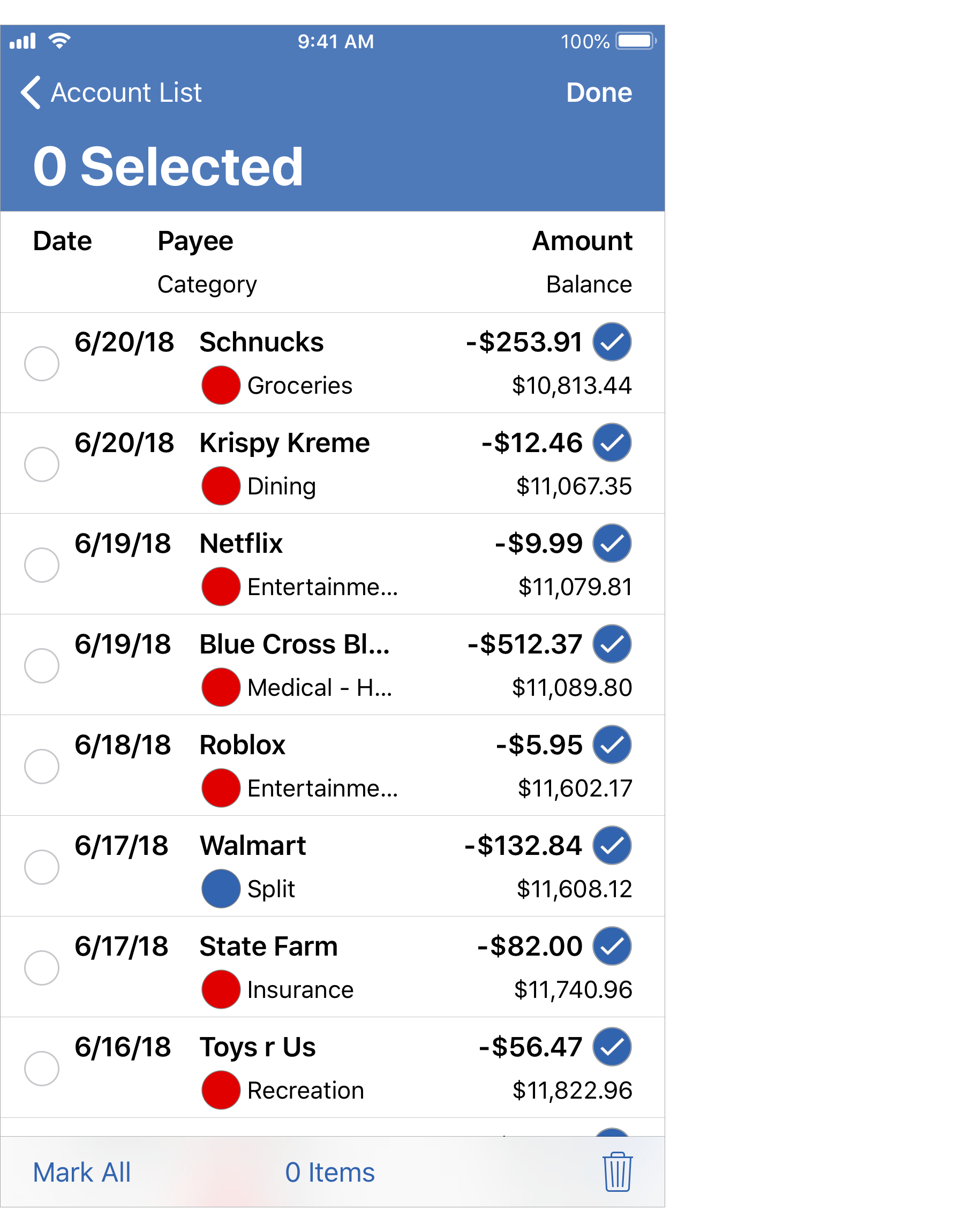

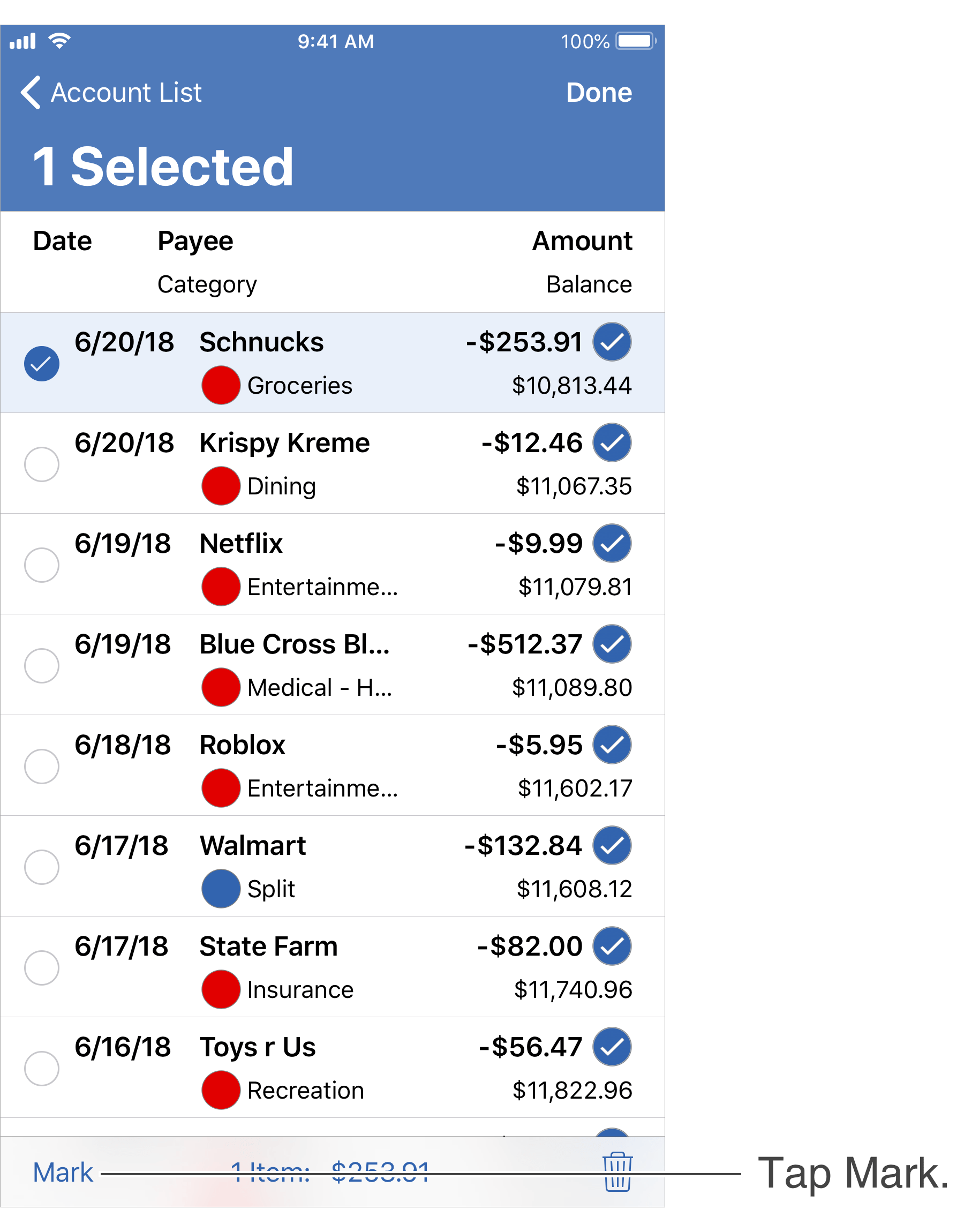

- Tap "Edit" on the top right.

- Tap each transaction you want to mark as reconciled to select them.

- Tap the "Mark" option on the lower left.

- Tap the "Mark as Reconciled" option.

- Tap "Done" on the upper right to end editing.

![]() Tip:

You can mark all transactions as reconciled at once.

To do so, tap "Edit" on the top right.

Then tap the "Mark All" option on the lower left and choose the "Mark All as Reconciled" option.

Tip:

You can mark all transactions as reconciled at once.

To do so, tap "Edit" on the top right.

Then tap the "Mark All" option on the lower left and choose the "Mark All as Reconciled" option.

Reconcile an account:

Although you can mark transactions as "Reconciled" at any time, it can be much easier to do so from oldest to newest when compared against the institution's records. The first task when reconciling an account is verifying you're not already starting with a discrepancy. If you are reconciling against an official statement, make sure the "Reconciled" balance in the program is the same as the statement's beginning balance. If you are reconciling against the transaction records on the institution's website or app, make sure the "Reconciled" balance in the program is the same as of where you left off reconciling against the transaction records at the institution. If there is already a discrepancy then you should track down the discrepancy by going back to a fresh starting point and reconcile the account from there before attempting to reconcile additional transactions. If your starting point is correct begin matching transactions from your records to those of the institution.

Match transaction records:

Go through each transaction as listed on the institution's statement or on the institution's website or app and do the following:

- Validate: Review the transaction for being an actual legitimate transaction. It is not uncommon for mistakes to be made such as being overcharged or incorrectly charged.

- Match: Find the matching transaction in the program. Be absolutely sure the transaction's amount matches and there isn't a discrepancy such as being over or under charged. If there isn't a match, you can add the matching transaction to your records. If you find what should be the match, but isn't recorded properly, you can edit an existing transaction that should be the matching transaction as appropriate.

- Reconcile or Flag: If you found a matching transaction in your records, mark it as reconciled. If you found a matching transaction that isn't legitimate, you can go ahead and mark it as reconciled or leave it as it is. Then you should flag the transaction as "Needs further review", or with your own custom flag, and contact the institution regarding the transaction.

Repeat these steps until you have reviewed all of the transactions listed by the institution. Ideally when you are done you will have matched and reconciled every transaction from the institution to ones in your records and the "Reconciled" balance for your records will match the ending balance you are reconciling against at the institution. If it doesn't, then you will need to track down the discrepancy.

![]() Tip:

It is an option to mark multiple transactions as reconciled at once.

If you can easily identify the ending balance you are trying to reconcile against at the institution matches the balance in the program, then you can review the transactions up to that point for being valid, and then mark them all as reconciled.

Tip:

It is an option to mark multiple transactions as reconciled at once.

If you can easily identify the ending balance you are trying to reconcile against at the institution matches the balance in the program, then you can review the transactions up to that point for being valid, and then mark them all as reconciled.

Tracking down discrepancies:

After comparing your transaction records to the institution's transaction records the "Reconciled" balance for the account in the program should match the ending balance at the institution for the period you are reconciling against. If there's a discrepancy it should be one of the following: (1) one or more missing transactions in your records, (2) one or more transactions in your records not marked as "Reconciled", or (3) a transaction was marked as reconciled inappropriately such as one marked as reconciled, but it had the incorrect amount. Finding the discrepancy can be difficult at times and requires paying close attention to the details of each transaction, especially their amounts. First, check for any transaction(s) in your records that are not yet marked as reconciled as those can be easily identified. Next, go back through the institution's records and make sure you didn't miss recording any of them in your records. If you still have a discrepancy then you will need to get back to a fresh starting point that you can reconcile the account from where the reconciled balance in the program matches the balance at the institution.